As the end of the year approaches, many Americans once again begin thinking about tax-saving strategies — including the longstanding benefits of charitable contributions. As you consider the gift that is right for you, below are opportunities that may provide tax savings while helping you achieve your financial and charitable goals.

Make year-end annual exclusion gifts of up to $17,000 ($34,000 for married couples) per recipient. There is no limit to the number of donees and there is no requirement that the recipients be related to the donor.

- Make year-end retirement plan contributions.

- Create 529 Plan accounts before year-end for children and grandchildren and consider front-loading the accounts with five years’ worth of annual exclusion gifts, taking into account any gifts made during the year to children and grandchildren. For example, a married couple in 2023 can fund a 529 plan for a child with up to $170,000 (5 x$34,000), using up the annual exclusion allowance for that child for the years 2023 through 2027.

- Pay tuition and non-reimbursable medical expenses directly to the school or medical provider.

Charitable Giving Tips for 2023

- Make charitable gifts before year-end to reduce your tax liability for 2023.

- When considering which assets to donate to charity, consider the significant benefit of contributing appreciated securities, owned for more than one year. In addition to a charitable income tax deduction equal to the fair market value of the securities on the date of gift, you will avoid ever having to pay tax on the appreciation.

- Tax-Advantaged Portfolio rebalancing: Donate your highly appreciated stock in an over concentrated position, use the tax savings to reinvest in stock that will bring you back to your desired asset allocation.

- Qualified Charitable Distributions (QCDs): If you are over 70½, consider QCDs, also known as charitable IRA rollovers. Currently, each IRA owner over the age of 70½ can direct up to $100,000 every year from an IRA to qualified charitable organizations.

- If you are age 73 and older, your required minimum distribution is reduced, dollar for dollar, by the QCD amount.

- For the first time, you can now direct up to $50,000 of your QCDs to establish a charitable gift annuity or charitable remainder trust and receive an income for life. Under current law, you are only allowed to make this type of QCD once.

- Make sure beneficiary designations are up to date and consider naming Brown. The significant income tax burden on most retirement plans makes them ideal assets to donate to Brown University because they pass to the University free of income tax.

A Preview of Coming Attractions

- Beginning in 2024, the annual limit for qualified charitable distributions (QCDs) is indexed for inflation.

- Similarly, the one-time maximum transfer of a $50,000 QCD in exchange for a CGA or CRT, will also be indexed for inflation.

Beneficiary Designations

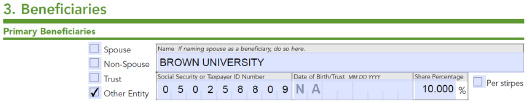

There are a few things to know about making Brown a beneficiary of your retirement plan. Most forms will ask for your relationship to the beneficiary. In the example from Schwab included here, check the box for “Other Entity.” Enter Brown University in the name space. Use Brown’s tax identification number, which is 05-0258809. Mark the date of birth as NA.

Beneficiary designation forms usually ask that you enter a percentage of the balance for charity and heirs. If you are leaving the entire remaining balance to Brown, enter 100%. Otherwise, you can allocate any percentage amount you like. To ensure that your gift has the lasting impact you envision, you can provide us with instructions for how you would like your future gift to be used.

If you participate in an employer sponsored plan, such as 401(k), your spouse must waive his or her right to be the beneficiary in favor of Brown. Alternatively, with an IRA, you don’t generally need spousal consent to make Brown the primary beneficiary unless you live in a community property state.

The example below illustrates how to make Brown a beneficiary of a Schwab retirement plan. Other administrators will use similar forms.