Make a Gift with a Donor Advised Fund

Donor advised funds (DAFs) are an increasingly popular way to make a charitable gift. DAFs can provide you with immediate tax benefits while making your charitable giving easier. Here are some simple ways you can make a gift through your DAF:

- Make an outright gift by suggesting a grant to Brown University.

- Set up Brown to receive recurring annual distributions for an area or program you care about, like the Brown Annual Fund.

- Designate Brown as an ultimate beneficiary of a portion or all of the fund.

You can select the option that best suits your philanthropic and financial goals to support Brown. Just contact your fund administrator to request a distribution or beneficiary form or download the appropriate form(s) from your administrator’s website.

If you include Brown University in your plans, please let us know so we can welcome you into the College Hill Society. Our legal name and federal tax ID are below.

Legal Name: Brown University

Address: Providence, RI 02912

Federal Tax ID Number: 05-0258809

Creating a Donor Advised Fund at Brown

Establishing a Brown donor advised fund is an easy and cost-effective way to support the University and other causes and organizations you care about.

How It Works

|

GIVE Make an initial gift of $100,000 or more to initiate the fund. In most cases your contribution will qualify for a charitable income tax deduction. |

|

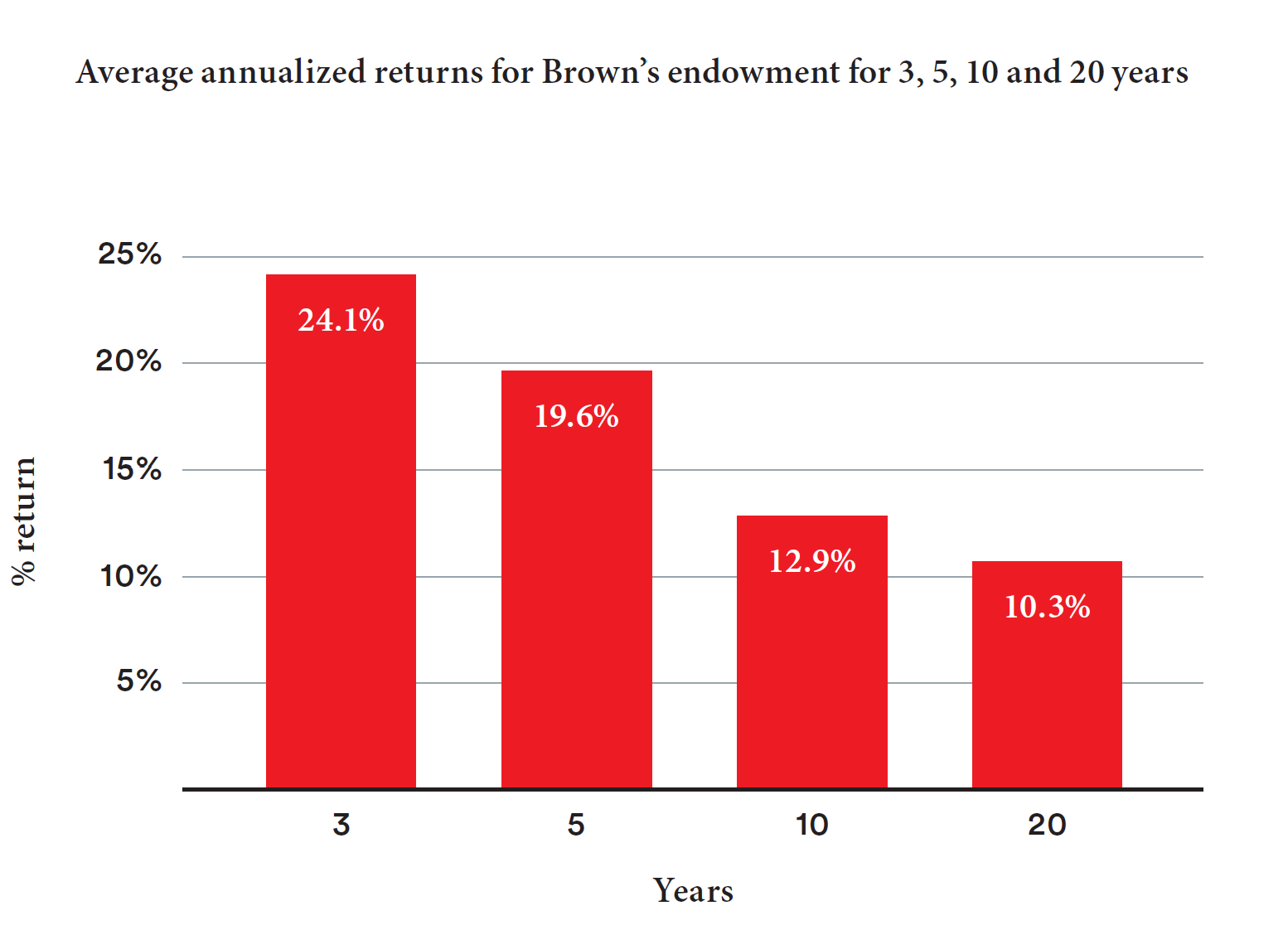

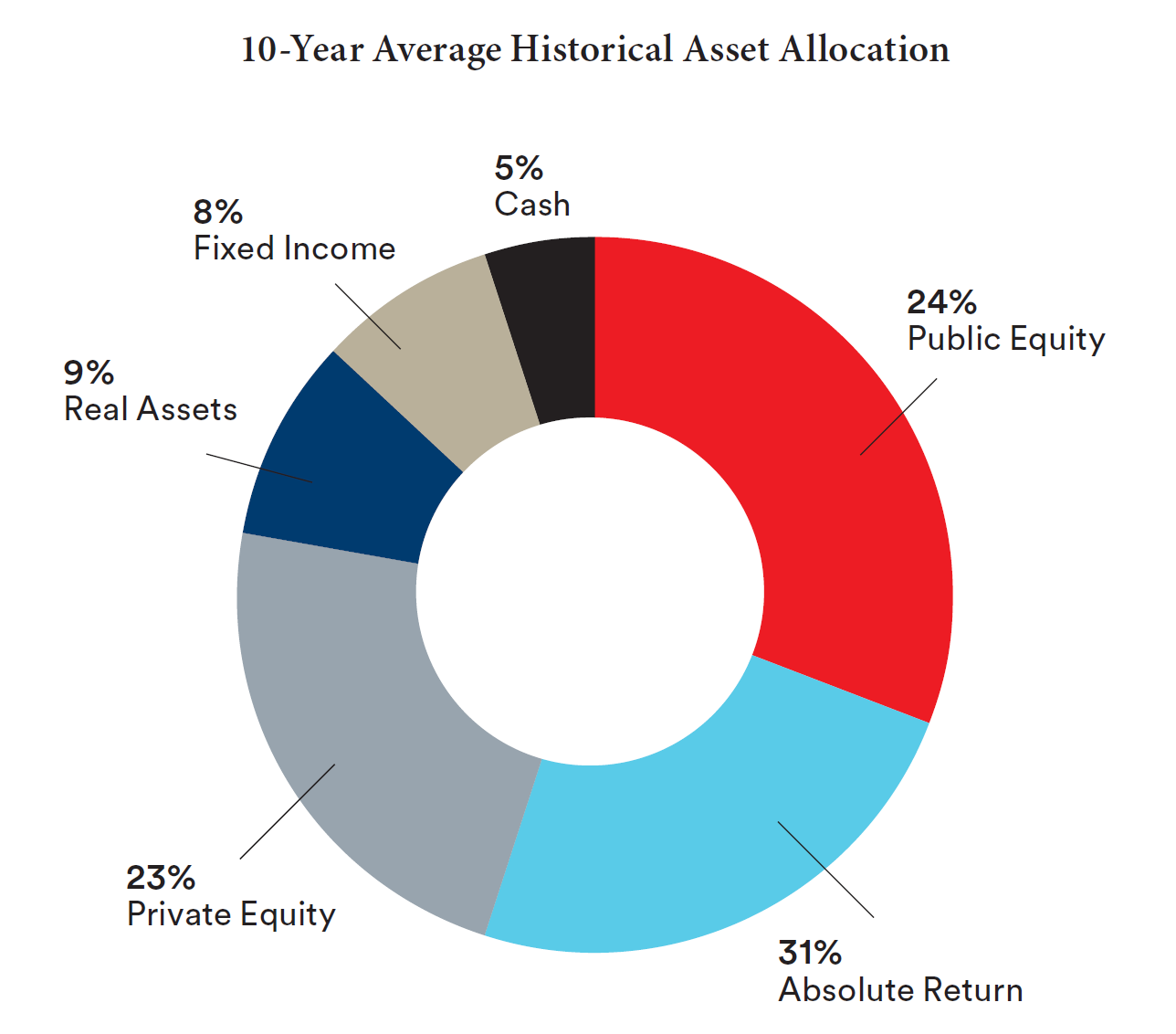

GROW Invest in Brown’s endowment or in a money market pool. |

|

GRANT When you’re ready to support Brown or other organizations, you can request to make distributions from your fund through the Office of Philanthropic Strategies and Planned Giving. At least 25% of all contributions must be to Brown. |